Overview

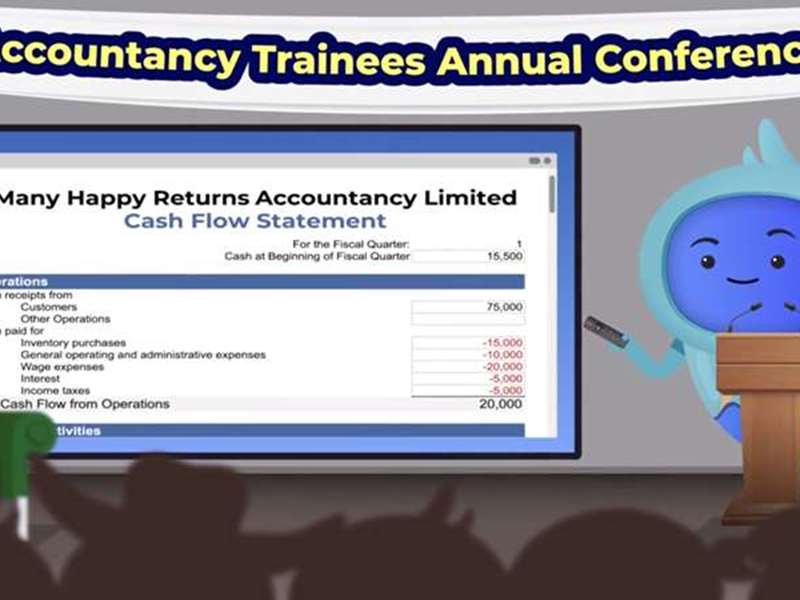

If you’re dealing with your company’s accounts, then you’ll likely have an idea about the importance of cold, hard cash to a business already. But when you receive cash or indeed spend it, you’ve simply got to deal with it in the correct way. And that means creating a Cash Flow Statement

Why? Simply put, a CFS is important not only for looking at a business’s overall financial health, but to check its operating profitability. You need to know how much cash is available to pay your bills and work out a company strategy

By the end of this course, you’ll be able to:

- Define what a Cash Flow Statement is

- Demonstrate how to create a Cash Flow Statement

- Explain the importance of good cash flow to a business

Why should I take this course?

If you’re new to running a company’s accounts, then you’ll need to know the ins and outs of all the business dealings. How else can you keep track of finances? A CFS should be able to tell you and investors at a glance just how healthy your business is. Learning how to put one together is an investment you must make in yourself, and it’s one that will always pay dividends.